DEFINE YOUR OWN BOUNDARIES

KNOCK-OUTS

Speculate on market movements with weekly knock-out contracts,

also known as Touch Bracket™ contracts. Pick a floor and a ceiling –

set risk and reward on your own terms.

Why trade knock-outs?

Trade with a set plan.

If the floor or ceiling is hit, you’re automatically knocked out of the trade. This protects your profits and limits losses.

Make your forecast for the rest of the week.

Knock-out contracts expire at the end of the week – unless the floor or ceiling is hit first.

Set your knock-out boundaries.

Your contract comes with a floor and ceiling built in. Think of these as your take profit and stop loss levels.

Trade flexibly.

Hold your contract until you’re knocked out or it expires. Or, if you change your mind, you can exit the trade early, too.

What are knock-out contracts?

- What are TradeProOptio Knock-Outs and how do they work?

- How do I manage risk?

Knock-out contracts are financial instruments that offer opportunities to speculate on the markets with a set floor and ceiling. You can make money if the market moves in the direction you predict. If the floor or ceiling is hit, you’re knocked out of the trade – if you’ve made a profit, it’s yours to keep, and if you’ve taken a loss, it’s limited.

No trade is without risk and there is always a chance of losing capital. You need to be aware of – and able to cope with – all possible outcomes. Here’s your essential guide to risk management strategies.

Trade anywhere, anytime

Register Your Account Today

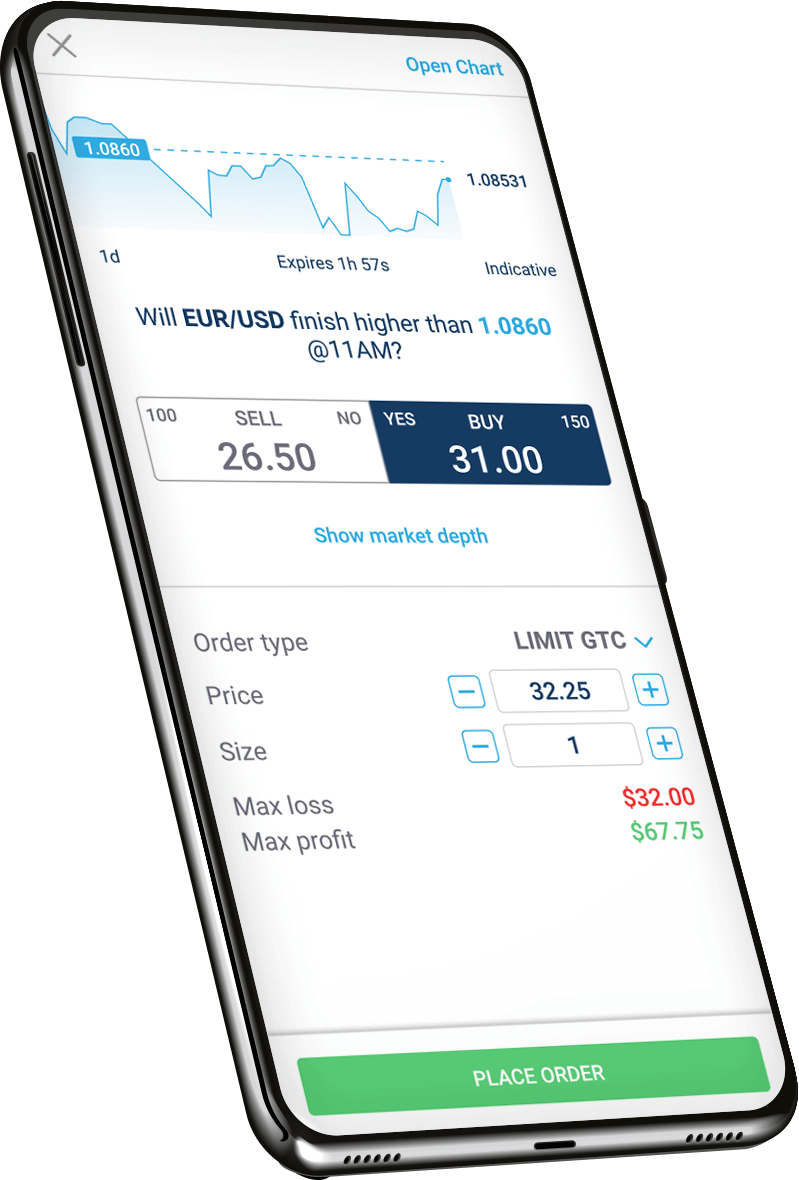

TRADEPROOPTION™ for mobile

Trade knock-outs from your phone – access the markets anywhere, anytime. Get all the same features on the go, including charts, drawing tools, and technical indicators.

TRADEPROOPTION™ for mobile

Access the TradeProOptio platform and trade knock-outs from a desktop. Use a dynamic and robust suite of charts and tools – trade your way, where you want, when you want.